What Happens If You Get More Scholarships Than Tuition

What Happens If You Get More Scholarships Than Tuition - We all know that scholarships are a great way to help pay for college tuition and other related costs. But what if you get too many scholarships, or more scholarships than you need to cover tuition? What happens if you get more scholarships than tuition? While it may seem like a dream come true, there are a few things to consider before you take on too many scholarships.

Source: bold-org.ghost.io

Source: bold-org.ghost.io

Tuition-Specific Scholarships

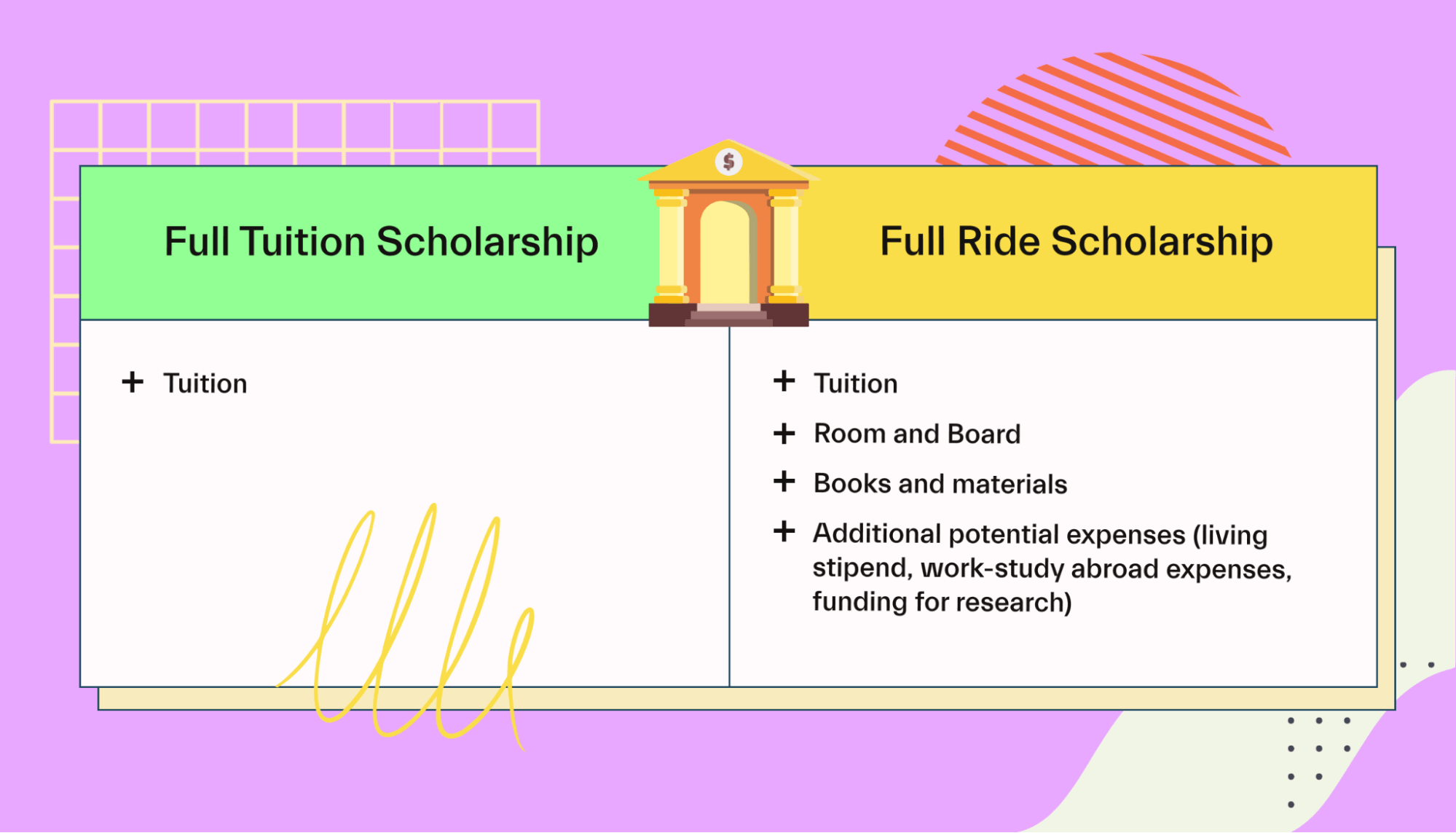

The first thing to consider is whether the scholarships you receive are tuition-specific or not. Many schools and organizations offer tuition-specific scholarships, which means the money is earmarked for tuition and related costs. If you receive scholarships for tuition that are more than the amount of tuition you owe, the excess funds will typically be returned to the awarding organization. Alternatively, the excess funds can sometimes be used for other school-related expenses such as textbooks or living expenses.

Source: img.money.com

Source: img.money.com

Scholarship Refunds

In some cases, you may be able to receive a refund of the excess scholarship funds. Depending on the organization or school that is giving the scholarship, you may be able to apply for a refund of the excess funds. This is usually done by submitting a formal request to the organization or school. It's important to note, however, that not all organizations or schools offer refunds for excess scholarship funds.

Tax Implications

Source: www.mos.com

Source: www.mos.com

Another important factor to consider when you receive more scholarships than tuition is the potential tax implications. If the scholarship funds are from a taxable source, then you will likely need to report the excess scholarship money as taxable income. This means you may have to pay taxes on the excess scholarship funds. It's important to speak with a tax professional to determine the exact tax implications of receiving excess scholarship funds.

Gift Aid

In some cases, you may be able to use the excess scholarship funds to help pay for other educational costs. This is known as gift aid and can be used to pay for expenses such as textbooks, laptops, or other school-related costs. Gift aid is typically tax-free, so you won't have to worry about any tax implications. It's important to keep in mind, however, that gift aid is typically only available if the scholarship funds are from a non-taxable source.

Source: i.pinimg.com

Source: i.pinimg.com

Saving the Money

Finally, you may also want to consider simply saving the excess scholarship funds. This is a great way to save for future educational expenses, such as graduate school or a summer abroad program. If you do decide to save the money, make sure you keep it in a secure, interest-bearing account. This will ensure that the money is safe and that it can grow over time.

Conclusion

Getting more scholarships than tuition can seem like a great opportunity, but it's important to consider all the factors before taking on too many scholarships. Tuition-specific scholarships may need to be returned, and you may have to pay taxes on excess scholarship funds from taxable sources. You may also be able to use the excess funds as gift aid or save it for future educational expenses. No matter what you decide to do, it's important to consider all your options before taking on too many scholarships.