Florida Tax Credit Scholarship

Florida Tax Credit Scholarship - Florida is one of the most popular states in the U.S. for its beaches, culture, and the sunshine state atmosphere. But what many people don’t realize is that the state of Florida also offers a great tax credit scholarship program. The program is designed to provide financial assistance to families to help pay for their children’s education. This tax credit scholarship can help reduce the cost of tuition for attending public or private school.

- What is the Florida Tax Credit Scholarship?

- Who is Eligible for the Florida Tax Credit Scholarship?

- How Do You Apply for the Florida Tax Credit Scholarship?

- What are the Benefits of the Florida Tax Credit Scholarship?

- What are the Restrictions of the Florida Tax Credit Scholarship?

- Where Can You Find More Information About the Florida Tax Credit Scholarship?

- Conclusion

Source: blog.stepupforstudents.org

Source: blog.stepupforstudents.org

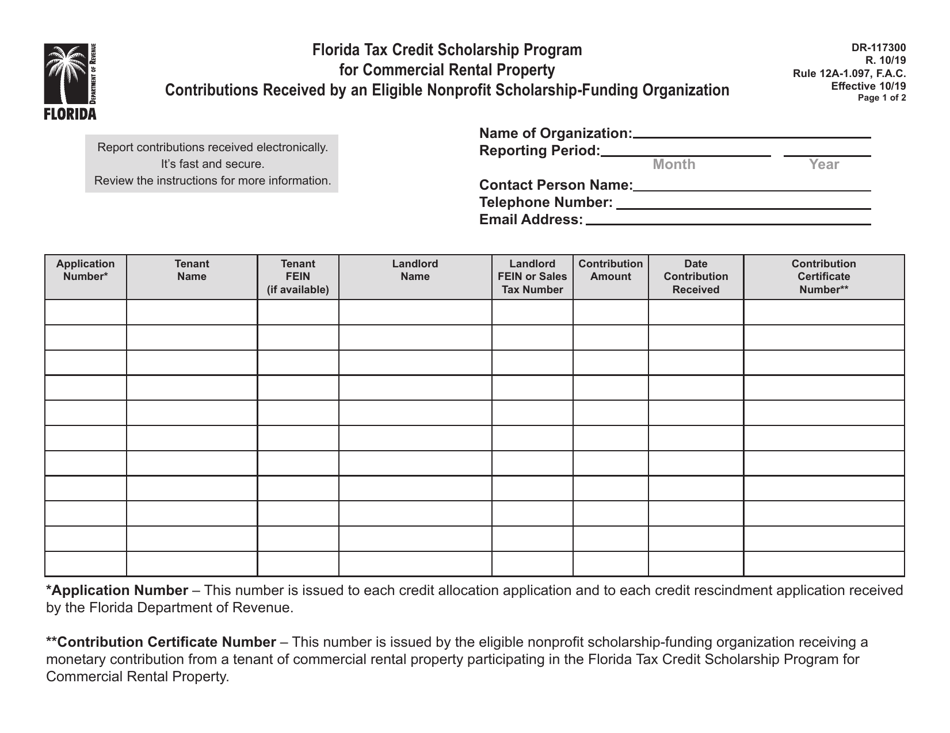

What is the Florida Tax Credit Scholarship?

The Florida Tax Credit Scholarship is a program that was created in 2001 to provide families with financial assistance to help pay their children’s tuition at public or private schools. The program is funded by contributions from corporations, and the contributions are then used to provide scholarships to eligible children. The program provides up to $7,000 for eligible students in grades K-12.

Source: data.templateroller.com

Source: data.templateroller.com

Who is Eligible for the Florida Tax Credit Scholarship?

To be eligible for the Florida Tax Credit Scholarship, the student must be a resident of the state, and the student’s family must meet certain income requirements. The family must also meet the state’s criteria for financial need. The state also requires that the student have a certain grade point average (GPA) or academic performance.

How Do You Apply for the Florida Tax Credit Scholarship?

Source: www.stepupforstudents.org

Source: www.stepupforstudents.org

The process to apply for the Florida Tax Credit Scholarship is relatively simple. First, the student must fill out the application form, which can be found on the official website. Once the application is submitted, the student will be notified of their eligibility within a few weeks. If the student is eligible, they will receive an award letter, which will provide information on the amount of the scholarship they are eligible for.

What are the Benefits of the Florida Tax Credit Scholarship?

One of the main benefits of the Florida Tax Credit Scholarship is that it helps to reduce tuition costs. This can be especially helpful for families who may not have the financial means to pay for their children’s education. Additionally, the scholarship can also help to provide access to quality education, as it can be used to attend a variety of public and private schools.

Source: www.educationnext.org

Source: www.educationnext.org

What are the Restrictions of the Florida Tax Credit Scholarship?

There are a few restrictions to the Florida Tax Credit Scholarship. First, the student must be a resident of the state. Additionally, the student must meet all of the eligibility requirements, including academic performance, financial need, and other criteria. Finally, the scholarship is not available to students who are in college or university.

Where Can You Find More Information About the Florida Tax Credit Scholarship?

For more information about the Florida Tax Credit Scholarship, you can visit the official website for the program. Additionally, you can contact your local school district or private school to see if they offer the scholarship. Finally, you can also contact your state’s Department of Education to learn more about the program.

Conclusion

The Florida Tax Credit Scholarship is a great way for families to help pay for their children’s education. The program provides financial assistance to eligible students, and can help to reduce tuition costs. However, there are a few restrictions to the program, including residency requirements and academic performance. If you are interested in learning more about the program, you can visit the official website or contact your local school district or private school.

step up scholarship florida, florida tax credit scholarship ftc, step up for students ema account, ema step up for students, florida tax credit scholarship program, ema scholarship, step up for students, tax credit scholarship program