529 Withdrawal Scholarship

529 Withdrawal Scholarship - In the year 2023, 529 withdrawal scholarships are becoming increasingly popular as a way for parents to help fund their children's college education. With tuition costs continuing to rise, more families are turning to this option as a way to make college more affordable. But what exactly is a 529 withdrawal scholarship, and how can parents make sure they make the most of it? In this article, we'll explore the basics of 529 withdrawal scholarships and provide some tips on how to get the most out of this financial aid option.

Source: theeducationplan.com

Source: theeducationplan.com

What Is a 529 Withdrawal Scholarship?

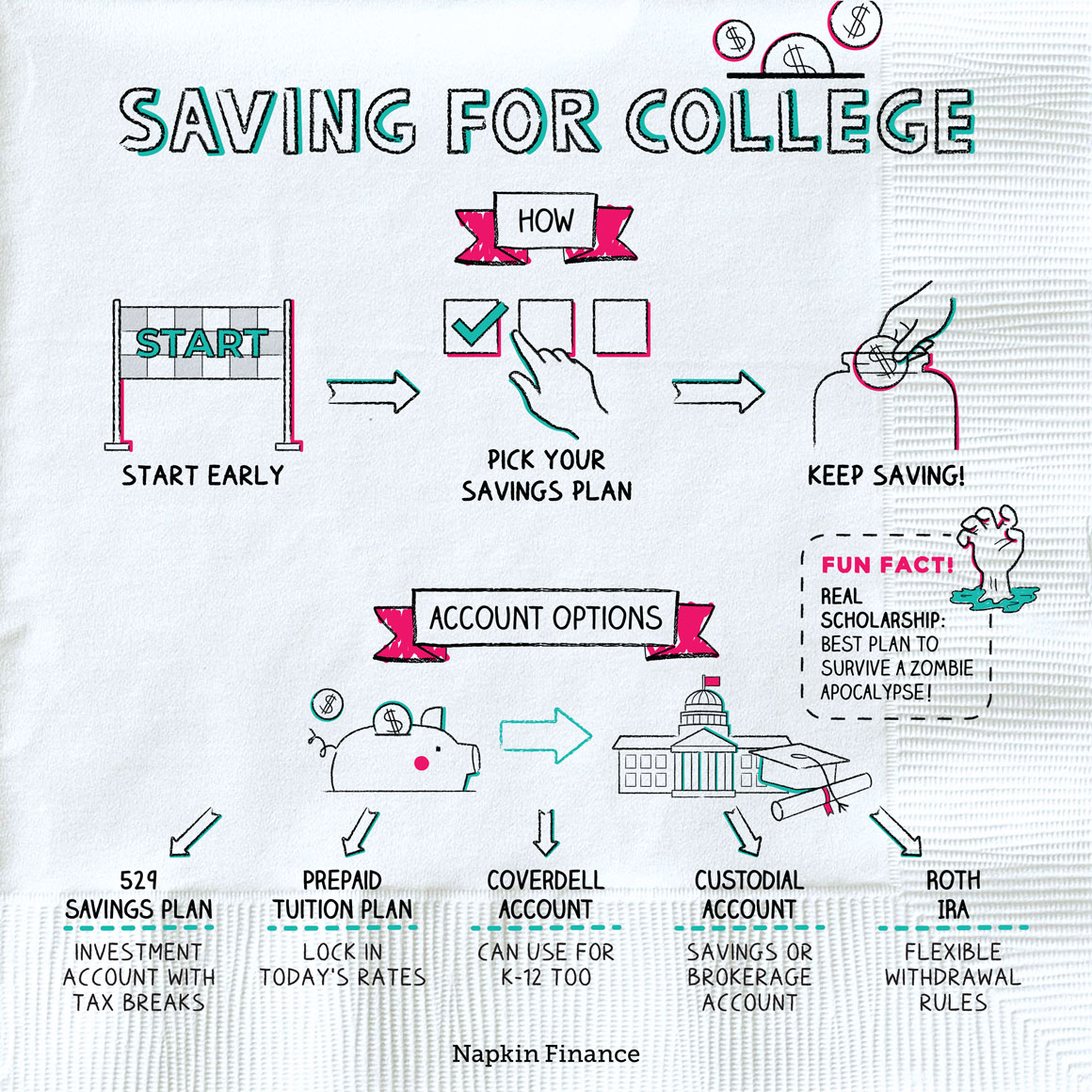

A 529 withdrawal scholarship is a type of financial aid that is funded through a 529 savings plan. 529 plans are tax-advantaged investment accounts that allow parents to save for their children's college education. When a 529 plan is used for a college education, withdrawals are tax-free. And, in some cases, a portion of the 529 plan can be used as a scholarship to help pay for college.

Source: www.riverviewcapital.com

Source: www.riverviewcapital.com

The 529 withdrawal scholarship works in a similar way to other types of scholarships. The parent can withdraw a certain amount of money from their 529 plan and use it to pay for college expenses. The amount withdrawn will depend on the total amount in the 529 plan, as well as the amount of money needed for college expenses. The money withdrawn can be used for tuition, fees, room and board, and other college-related expenses.

How to Qualify for a 529 Withdrawal Scholarship

In order to qualify for a 529 withdrawal scholarship, parents must first open a 529 savings plan. There are many different types of 529 plans, so it is important to research the plan that best fits your individual needs. Once a 529 plan is opened, the parent must contribute to the account for at least five years prior to withdrawing any funds. This will help ensure that the parent is able to take full advantage of the tax savings associated with 529 plans.

Source: napkinfinance.com

Source: napkinfinance.com

In addition to opening a 529 plan, the parent will also need to complete any required paperwork in order to qualify for the 529 withdrawal scholarship. This paperwork may include a Free Application for Federal Student Aid (FAFSA), as well as documentation of the parent's income and financial position. Once the paperwork is completed and submitted, the parent can then apply for the 529 withdrawal scholarship.

Tips for Maximizing a 529 Withdrawal Scholarship

Once a 529 plan is in place and the parent has qualified for a 529 withdrawal scholarship, there are some steps that can be taken to maximize the amount of money received. First, it is important to maximize contributions to the 529 plan. The more money that is in the account, the more money can be withdrawn for college expenses. Additionally, a parent can increase the amount of money withdrawn by investing in higher-yield investments such as stocks or mutual funds.

Source: www.usatoday.com

Source: www.usatoday.com

Another way to maximize the 529 withdrawal scholarship is to look for additional scholarships or grants that can be used to supplement the amount of money received from the 529 plan. Many colleges and universities offer scholarships or grants to students who demonstrate financial need. And, there are many private organizations that offer scholarships to students who demonstrate academic excellence or have unique backgrounds or interests.

Finally, it is important to understand the tax implications of a 529 withdrawal scholarship. Withdrawals from a 529 plan are tax-free when used for college expenses. However, there are some restrictions on how the funds can be used. For example, the funds cannot be used to pay for non-college-related expenses. Additionally, the parent must keep detailed records of how the funds are being used in order to ensure that the money is being used for college expenses.

Conclusion

A 529 withdrawal scholarship can be a great way to help parents pay for their children's college education. However, it is important to understand the basics of how a 529 plan works and what the tax implications of a withdrawal are. By taking the time to research and understand the details of a 529 plan, parents can make sure they are making the most of this financial aid option.

irs 529 qualified expenses, 529 scholarship reimbursement rules, 529 scholarship rule, can i withdraw only principal from 529, irs 529 plan withdrawal rules, how to withdraw from 529, 529 withdrawal rules timing, how to access 529 funds