529 Plan And Scholarships

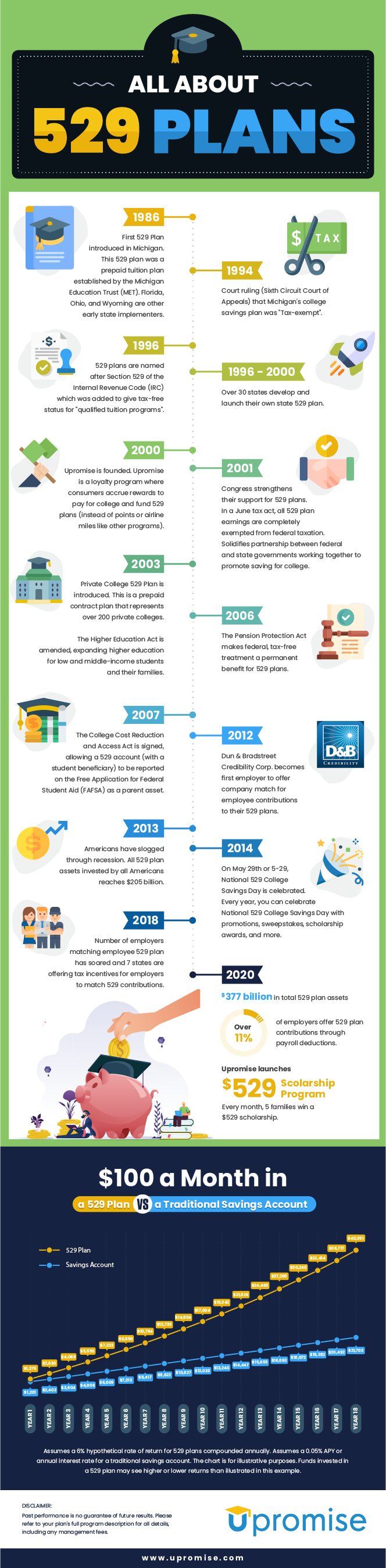

529 Plan And Scholarships - A 529 plan is a tax-advantaged savings plan designed to encourage saving for future college costs. It is named after Section 529 of the Internal Revenue Code, which created these types of savings plans in 1996. 529 plans are sponsored by states, state agencies, or educational institutions and are authorized by Section 529 of the Internal Revenue Code. 529 plans are investment accounts that can be used to save for college costs. The money invested in a 529 plan grows tax-free, and distributions from the plan to pay for qualified higher education expenses are also tax-free. 529 plans are a great way to save for college and can also be used to help pay for scholarships.

Source: i.pinimg.com

Source: i.pinimg.com

What is a 529 Plan?

A 529 plan is an investment account created to help families save for college. It is a tax-advantaged savings plan that is sponsored by states, state agencies, or educational institutions and is authorized by Section 529 of the Internal Revenue Code. Contributions to a 529 plan are made with after-tax dollars, which grow tax-free. Once the money is withdrawn from the plan to pay for qualified higher education expenses, the earnings are tax-free. In addition, many states offer state tax deductions or credits for contributions to their state-sponsored 529 plans.

Source: www.upromise.com

Source: www.upromise.com

What Are the Benefits of a 529 Plan?

There are many benefits to a 529 plan. First, contributions to a 529 plan are made with after-tax dollars, which grow tax-free. Earnings from the plan are also tax-free when used to pay for qualified higher education expenses. In addition, many states offer state tax deductions or credits for contributions to their state-sponsored 529 plans. Another benefit of a 529 plan is that it is easy to set up and manage. Finally, a 529 plan can be used to pay for more than just college costs, such as room and board, books, computers, and other qualified expenses.

What Type of Expenses Can Be Covered by a 529 Plan?

Source: www.mother.ly

Source: www.mother.ly

529 plans can be used to pay for a variety of qualified higher education expenses, including tuition, room and board, books, computers, and other qualified expenses. In addition, 529 plans can also be used to pay for scholarships, which can help even more with the costs of college. It is important to note that 529 plans can only be used for qualified higher education expenses, so it is important to understand what qualifies as a qualified higher education expense before making any withdrawals.

Who Is Eligible to Participate in a 529 Plan?

Anyone can open and contribute to a 529 plan, including parents, grandparents, relatives, and friends. There are no income or age restrictions on who can participate in a 529 plan. However, the account owner (or beneficiary) must be a U.S. citizen or resident alien with a valid Social Security number. It is important to note that the account owner is the person responsible for managing the account and making sure that all contributions and withdrawals are used for qualified higher education expenses.

Source: i.pinimg.com

Source: i.pinimg.com

How Can I Get Started With a 529 Plan?

The first step in setting up a 529 plan is to decide which plan is right for you and your family. There are a variety of 529 plans available, so it is important to research the different plans to determine which one is the best fit. Once you have chosen a plan, you can open an account with the plan provider and start making contributions. Most 529 plans also offer automatic investment options, which can make saving for college even easier.

What Are the Risks Involved With a 529 Plan?

As with any investment, there are risks involved with a 529 plan. The primary risks are related to market conditions and changes in the value of the investments in the plan. It is important to understand the risks associated with a 529 plan before investing and to monitor the plan's performance regularly. Additionally, withdrawals from a 529 plan that are not used for qualified higher education expenses may be subject to taxes and penalties.

Conclusion

A 529 plan is an excellent way to save for college. It offers tax advantages, is easy to set up and manage, and can be used to pay for a variety of qualified higher education expenses, including scholarships. It is important to understand the risks associated with a 529 plan before investing and to make sure that all contributions and withdrawals are used for qualified higher education expenses. With the right plan, a 529 can be a great way to save for college and make college more affordable for your family.

529 plan and scholarship rules, does 529 plan affect scholarship, scholarships and 529 plan withdrawals, irs 529 plan withdrawal rules, 529 college savings plan scholarship, 529 scholarship exception, 529 and scholarship money, 529 withdrawal rules scholarship